The Problem of ATM Skimming: A Closer Look

ATM skimming is a serious problem that affects millions of people around the world. Criminals use skimming devices to steal sensitive information from unsuspecting ATM users, putting their financial security at risk. Understanding how these devices work is essential for protecting oneself from fraud. Read on to learn more about the dangers of ATM skimming and what you can do to stay safe.

How Skimmers Work

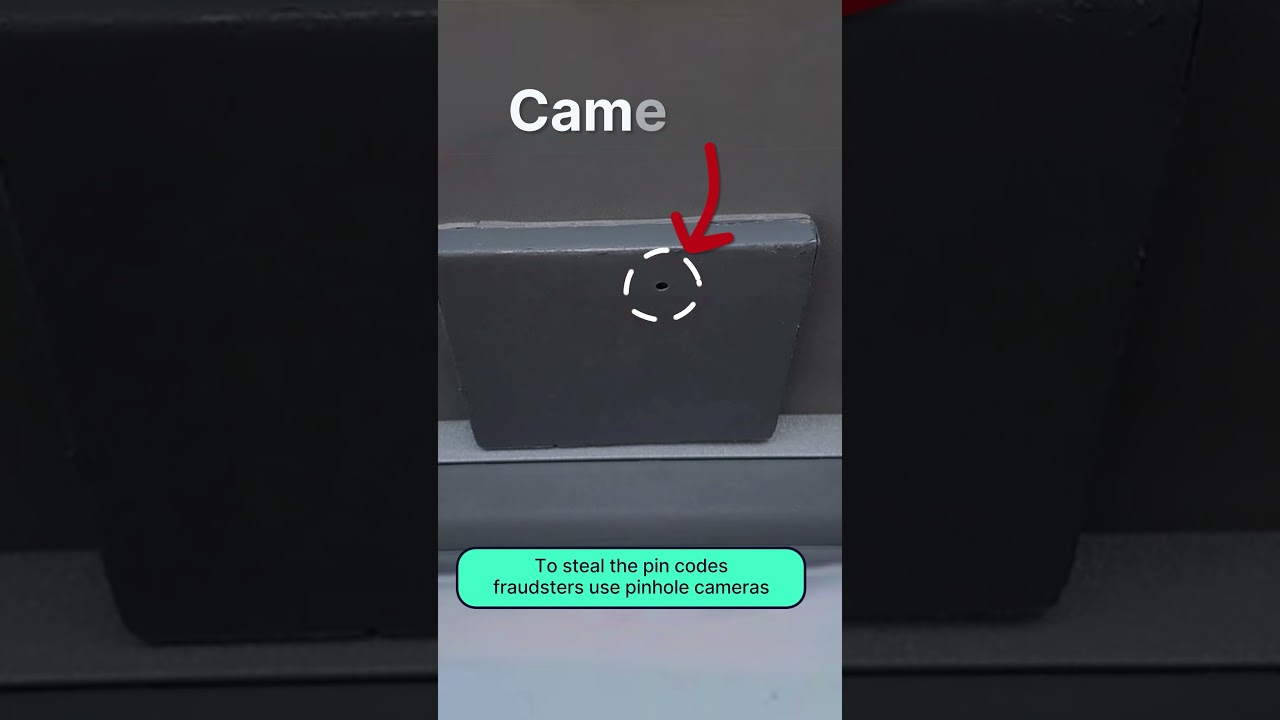

Skimmers are small, discreet devices that fraudsters attach to ATM machines. These devices are designed to capture the information from the magnetic strip of a debit or credit card when it is inserted into the ATM. In addition to skimmers, criminals may also use pinhole cameras to capture the PIN numbers of unsuspecting ATM users. This combination of stolen card data and PIN numbers allows criminals to make unauthorized transactions using the victim’s account.

Identifying Skimming Devices

Unfortunately, skimmers can be very difficult to detect. They are often designed to blend in seamlessly with the ATM, making them nearly invisible to the untrained eye. However, there are a few signs that consumers can watch out for, such as loose or misaligned card readers, or an excessive amount of glue on the ATM machine. If something about the ATM seems off, it’s best to find another machine to use.

Ultimately, the best defense against ATM skimming is awareness. By staying vigilant and paying attention to the details when using an ATM, consumers can reduce their risk of falling victim to skimming scams.

For more information about ATM skimming and other fraud prevention tips, visit Sumsub.

Remember, while skimming devices pose a real threat, there are steps that consumers can take to protect themselves. By being informed and cautious, individuals can minimize their risk and continue to use ATM machines safely and securely.